Revolutionizing Bank Statement Processing: Introducing the Automated Transaction Miner (ATM)

In today’s fast-paced financial landscape, processing and analyzing bank statements efficiently has become more crucial than ever. We are proud to introduce the Automated Transaction Miner (ATM), a sophisticated software solution designed to transform the way organizations handle their banking data. This powerful tool represents a significant leap forward in automated financial data processing, offering unprecedented efficiency and accuracy in managing multiple bank statement formats.

The Challenge of Modern Banking Data

Financial institutions, businesses, and organizations face an ever-growing challenge of processing vast amounts of transaction data from various banking sources. Each bank typically uses its own unique format for statements, making it increasingly difficult to standardize and analyze this information efficiently. Manual processing is not only time-consuming but also prone to errors, potentially leading to critical mistakes in financial reporting and analysis.

ATM: A Comprehensive Solution

The Automated Transaction Miner addresses these challenges head-on with its innovative approach to data processing. At its core, the software utilizes advanced pattern recognition and data normalization techniques to automatically process bank statements from multiple sources and formats, including Excel files (.xlsx, .xls), CSV files, text documents, and even PDF statements.

Key Features and Capabilities

One of the most impressive aspects of ATM is its intelligent template system. The software can recognize different bank statement formats automatically and apply the appropriate processing rules. This feature eliminates the need for manual template selection and significantly reduces the risk of processing errors.

The system excels in handling complex data transformations. It can process various date formats, normalize numerical values, and standardize transaction descriptions across different banking systems. The software is particularly adept at managing multiple currency formats and ensuring consistent output regardless of the input format.

Advanced Processing Capabilities

ATM incorporates sophisticated algorithms for:

- Automatic detection and processing of bank fees and internal transfers

- Intelligent parsing of transaction descriptions and partner information

- Advanced date and time normalization across different formats

- Accurate handling of various number formats and currency notations

- Comprehensive validation and error checking mechanisms

What sets ATM apart is its ability to maintain data integrity throughout the processing pipeline. Each transaction is carefully validated, and any anomalies are flagged for review, ensuring the highest level of accuracy in the output.

Practical Implementation and Benefits

Organizations implementing ATM have reported significant improvements in their financial data processing workflows. The software can reduce processing time by up to 90% compared to manual methods, while simultaneously improving accuracy and consistency.

The output is standardized into a uniform format, making it ideal for:

- Financial analysis and reporting

- Audit preparation

- Business intelligence applications

- Regulatory compliance

- Historical transaction analysis

User-Friendly Interface and Operation

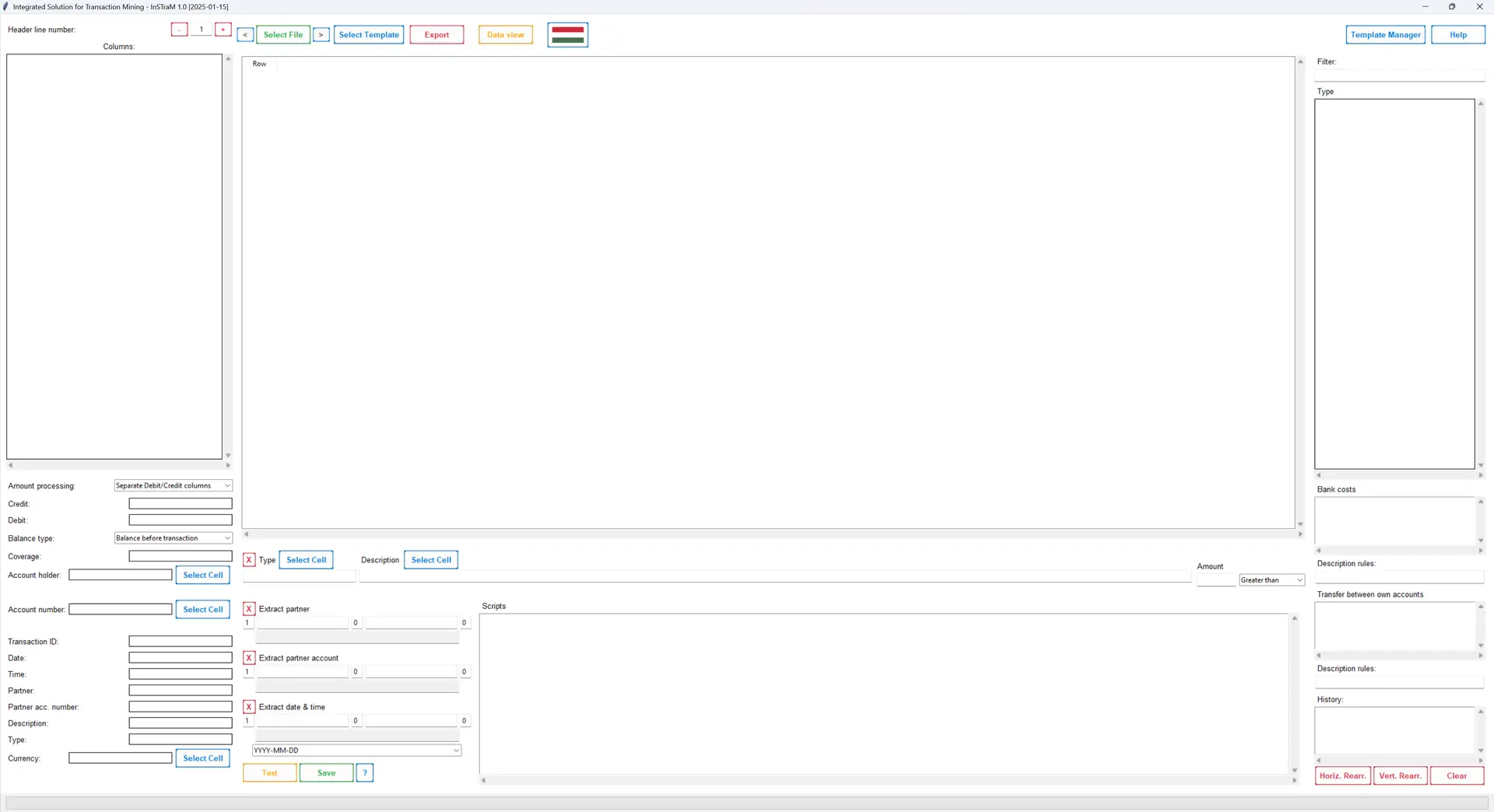

Despite its complex underlying technology, ATM features an intuitive graphical user interface that makes it accessible to users of all technical levels. The software guides users through the process with clear progress indicators and comprehensive logging, ensuring transparency throughout the operation.

Looking Ahead

As banking systems continue to evolve and new transaction formats emerge, ATM is designed to adapt and grow. The software’s modular architecture allows for easy updates and additions to its template system, ensuring it remains current with changing banking standards and requirements.

Conclusion

The Automated Transaction Miner represents a significant advancement in financial data processing technology. By automating the complex task of bank statement processing, it allows organizations to focus on analysis and decision-making rather than data preparation. Whether you’re handling hundreds or thousands of transactions, ATM provides the tools needed to process this data efficiently and accurately.

This powerful solution is ideal for financial institutions, accounting firms, and any organization dealing with multiple bank statements and large volumes of transaction data. With its combination of sophisticated processing capabilities and user-friendly operation, ATM is poised to become an indispensable tool in modern financial data management.